A life balance sheet will give you a snapshot of how you’re doing in life.

We all know what a financial balance sheet looks like. You have two columns, one containing your assets and the other containing your liabilities. Assets are items that can provide a future value or benefit. Liabilities, on the other hand, are those things which will create an obligation in the future.

Financial assets include items such as the following:

- Cash on Hand

- Bank Accounts

- Stocks

- Bonds

Here are some examples of financial liabilities:

- Credit Card Debt

- Unpaid bills

- Mortgage

- Car Loan

If you subtract liabilities from assets, you get your financial net worth. When your assets are equal to your liabilities, you have a net worth of zero. If your assets are less than your liabilities, you have a negative net worth. Lastly, if your assets are greater than your liabilities, you have a positive net worth.

You can follow a similar model to create a life balance sheet in order to determine your life’s net worth. In this post you’ll discover how to create your life balance sheet, calculate your life net worth, and then increase your life net worth.

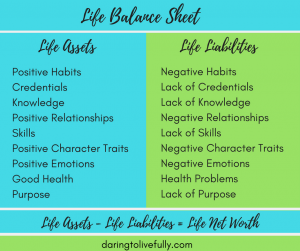

Life Balance Sheet – Assets

Your life assets include all those things which add value to your life and which will allow you to build a brighter future for yourself and your loved ones. The categories which I recommend you use for the “Life Assets” column of your life balance sheet include the following:

- Positive Habits –positive habits are those actions which you’ve put on automatic which allow you to move toward the achievement of your goals; e.g. exercising, meditating, and planning your day the night before.

- Credentials – the degrees, licenses, permits, or memberships in professional associations which you need in order to achieve your work and business goals.

- Knowledge – knowledge gained from books, online courses, experience, talking to others, and so on, is a huge asset.

- Positive Relationships – friendships, positive familial relationships, a strong professional network, and other life affirming relationships are assets.

- Skills – everything that you have the ability to do well—whether it be public speaking, creating videos, writing persuasively, etc.–is an asset.

- Positive Character Traits – positive character traits–such as grit, confidence, and integrity—are highly valuable assets.

- Positive Emotions – positive emotions such as gratitude, cheerfulness, and serenity can be added to your life balance sheet as wealth.

- Good Health – good health will result in high ability to focus, physical stamina, and endurance, all of which will allow you to build the kind of life you want for yourself.

- Purpose – setting empowering goals, having work that you find meaningful, and giving back to society will increase the “Assets” column of your life balance sheet.

Life Balance Sheet – Liabilities

On the right-hand column of your life balance sheet you’re going to list your life liabilities. Your life liabilities are all those things which decrease your ability to lead a good life and can potentially have a negative impact on your future.

The categories that I recommend you use for your “Life Liabilities” column are the following:

- Negative Habits – negative habits are those actions which you’ve put on automatic which prevent you from moving toward the achievement of your goals; e.g. smoking, overeating, and going to bed late.

- Lack of Credentials – not having the degrees, licenses, or permits which you need in order to achieve your goals, and not belonging to the necessary professional or trade associations, are big liabilities.

- Lack of Knowledge – lacking the knowledge that you need to achieve your goals is a liability; e.g. not having read important books, failing to invest in ongoing education, and not having the necessary experience.

- Negative Relationships – frenemies, toxic familial relations, bad relationships with co-workers, and strained relationships with neighbors should all be included in the right-hand column of your life balance sheet.

- Lack of Skills –each skill that you need to succeed, but which you lack, counts as a liability. This can include language skills, technological skills, communication skills, and so on.

- Negative Character Traits – negative character traits such as greed, envy, and negativity can prevent you from achieving what you want in life and they should be counted as liabilities.

- Negative Emotions – if you feel negative emotions on a regular basis–for example, anger, frustration, sorrow, and fear–these should be included as liabilities.

- Health Problems – poor health can result in a lack of ability to focus, illness, and lethargy, all of which should be listed as liabilities in your life balance sheet.

- Lack of Purpose – having disempowering goals, working at a job which you find meaningless, and failing to give back to society are all liabilities.

Life Balance Sheet – Net Worth

Just like with your financial balance sheet, if you subtract your life liabilities from your life assets you’ll get your net worth. In this case, a life net worth.

Going back to the financial balance sheet example, if your financial net worth isn’t what you would like for it to be, then you would look for ways to increase your assets and decrease your liabilities. But what if you’re not happy with your life net worth? What can you do to increase it?

Fortunately, there are many things you can do to increase your life net worth. Here are some ideas:

- Adopt a new positive habit, such as drinking eight glasses of water a day or doing some Tai Chi in the morning.

- Drop a negative habit, such as procrastinating or having a donut for breakfast every morning.

- Learn a new skill—pick a skill that will allow you to achieve your goals and learn it. This can include learning how to code, picking up conflict resolution skills, or learning photography.

- Practice an existing skill to become better at it.

- Read a book that will increase your knowledge in a life area that’s important to you (each book you read can be added as an asset).

- Take steps to become healthier and increase your energy levels.

- Look for ways to strengthen your positive relationships.

- Cut ties with people who are having a negative impact on your life (if they’re really mean you can go ahead and let them know that they’re a liability).

- Go back to school and get a degree.

- Get any necessary licenses or permits.

- Take a few online courses and share your certificates of completion on LinkedIn.

- Look for ways to increase the amount of time that you spend feeling positive emotions.

- Look for ways to reduce—or maybe even completely release–negative emotions.

- Work on strengthening your positive character traits.

- Look for ways to overcome your negative character traits.

- Set the goal of making your life more meaningful.

Make a list of all the things you’re going to do to increase your life net worth. Act. Then, four, five, or six months from now, create a new life balance sheet. Did your life assets increase? Did your life liabilities decrease? Is your life net worth higher?

Continue doing this until your life net worth is off the charts.

Benefits of Having a High Life Net Worth

Having a high financial net worth means that you have more money to spend on the things you want. It also means you have more security, and that you can take advantage of more investment opportunities.

A high life net worth, likewise, comes with many benefits. Here are some of them:

- You’ll be happier.

- You’ll be in a better position to achieve your goals.

- Your mental, physical, spiritual, and emotional well-being will be higher.

- You’ll be in a better position to help others, specially your loved ones.

- Your life journey will be a lot more pleasant with a high life net worth than with a low one.

As you can see, there are many reasons to get to work on your life net worth right away.

Conclusion

What’s your life net worth? How do you plan to increase it? Live your best life by creating your life balance sheet and making sure that your life net worth grows higher and higher with each passing year.

Related Posts:

Marelisa Fabrega is a lawyer and entrepreneur. She holds a Bachelor of Science in Business Administration from Georgetown University in Washington, D.C., as well as a Juris Doctor from the Georgetown University Law Center. You can learn more about her

Marelisa Fabrega is a lawyer and entrepreneur. She holds a Bachelor of Science in Business Administration from Georgetown University in Washington, D.C., as well as a Juris Doctor from the Georgetown University Law Center. You can learn more about her